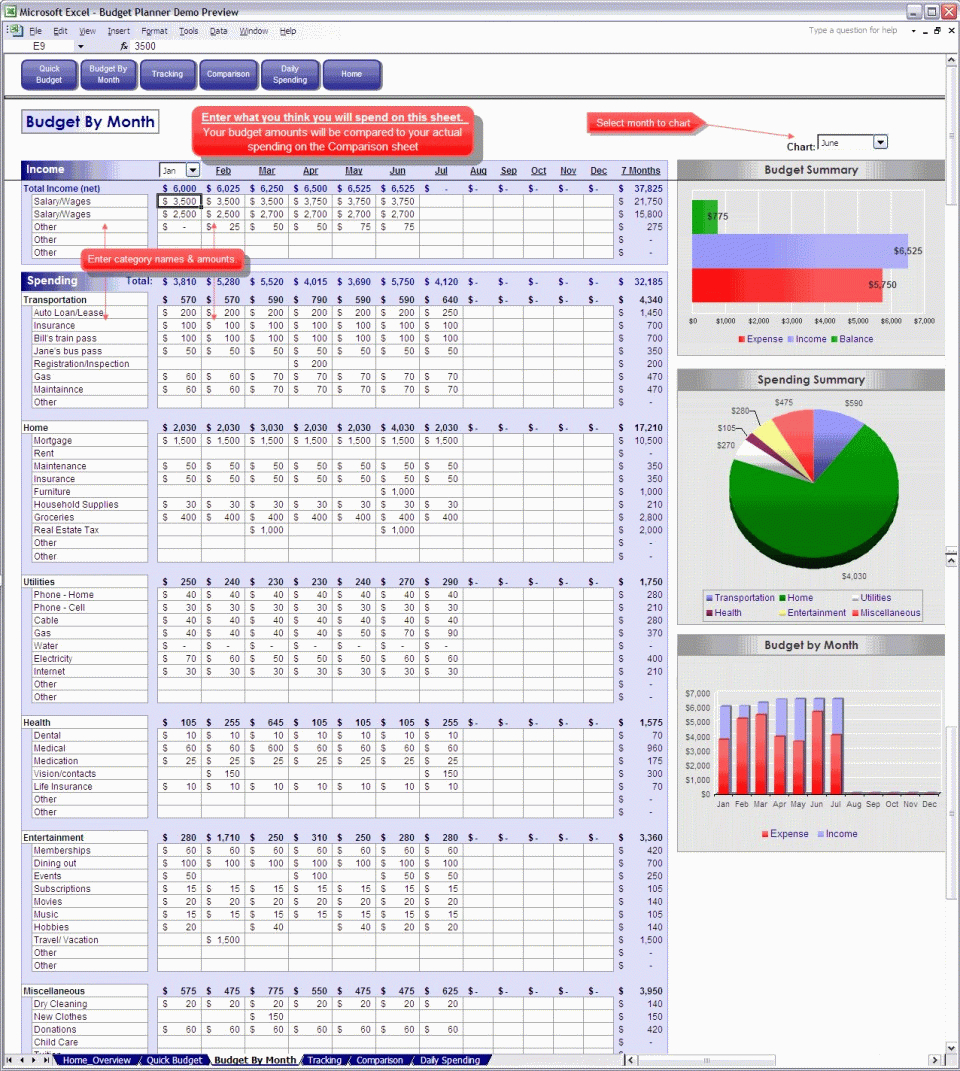

That means the average spending per year is $61,334. The average expenses per month for one consumer unit in 2020 was $5,111. The average single person spends $329 more per year than their take-home pay.Īverage monthly expenses per household: $5,111.Healthcare spending averages $431 per month.Transportation costs more than many realize ($819 per month), largely due to the intermittent nature of these expenses.Americans spend $610 on food per month, with about two-thirds being spent on groceries and the rest on eating out.Housing is the largest average cost at $1,784 per month, making up 34.9% of typical spending.The average annual income after taxes is $74,949.The average household's monthly expenses are $5,111 ($61,334 per year).Where does all that money go? For the typical person, it covers quite a few different things from major costs like payments to their mortgage lender and groceries to smaller expenses like apparel.īy peeking into the national average budget for all these categories, we can get a better idea of where people spend the most and how our own spending habits compare. The budget calculator will also help families establish their savings to debt ratio, and help them to take proactive steps to pay off any outstanding debt and increase their personal savings.The average monthly expenses for American households are $5,111, according to the most recent Consumer Expenditure Survey from the U.S. With this information at hand, it will be easier to develop a budget that covers all household essentials, while allocating money for discretionary spending such as charitable donations and recreation. The calculator will then figure estimates according to the general percentage values associated with a workable family budget. The calculator can be used to create either a monthly budget, or an annual budget buy simply entering the net income value in the appropriate field.

#Family household budget free

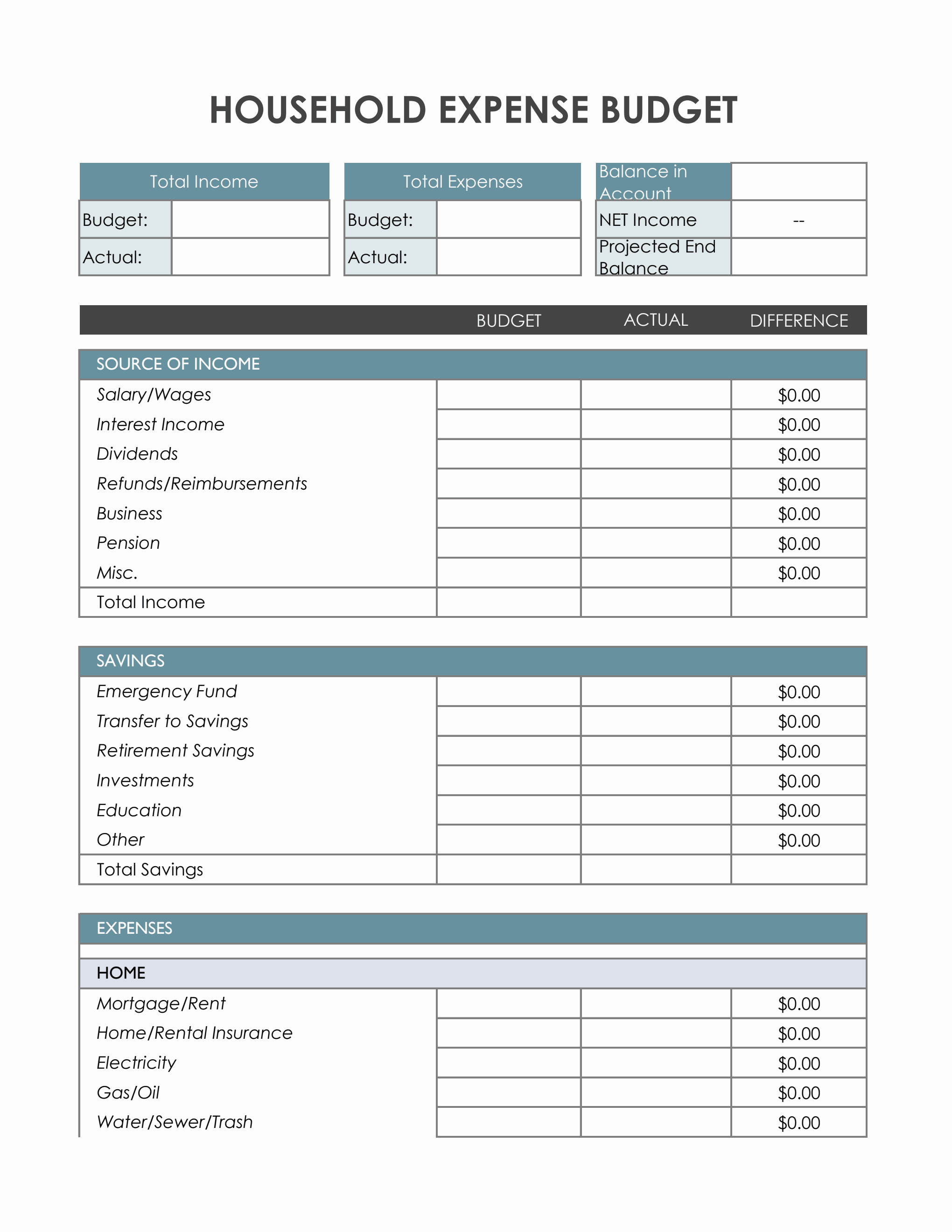

The free Budget Planning Calculator will help families better understand where their money is going, and create a budget that works for their financial situation. Those with higher incomes should be better able to balance their debt to savings ration, while those with lower incomes may find saving more difficult. Again, these percentages will be greatly influenced by the family income. Where more money is devoted to debt removal, less can be devoted to savings. Savings and DebtĪ family's ability to save money is in direct proportion to their outstanding debt.

Still, that being said, some general percentage values can be applied as general rules of thumb to help families build a better budget. Likewise transportation costs will rise or fall depending on the size of the family, and general work habits. Annual medial costs will largely depend on the size and the health concerns of the family. Secondary budgetary considerations, such as medical expenses, transportation and recreational spending, are more difficult to gauge. Alternatively, families with a higher income should find that the percentage of their household budget devoted to necessities is lower, and that more money is available for savings, personal expenses and charitable donations. Families with a limited income will find that their monthly and annual household necessities take up a large portion of their budget, and there will likely be less money left over for savings and discretionary spending. Depending on income, the percentage of the budget set aside for a family's necessities may be higher or lower. Necessities, like housing, utilities, food and clothing, typically make up the bulk of the family budget and are easier to plan for. This free tool will help you to see where your money is going, and how you can save for the future. But creating a family budget can be made easier with the Budget Planning Calculator.

How much is spent each month on transportation? How much on clothing, health care, recreation, and charitable donations? And more importantly, how much money can be devoted to savings for that inevitable rainy day? Each of these factors makes creating a monthly budget frustrating and often confusing, and when we extend that over the course of a year the tension really mounts. But other financial concerns also shape the family budget.

Most people have a fairly good handle on the necessities, and are well aware of the monthly costs of their rent or house payment, their utilities, and even their food costs. Creating a workable family budget can be difficult, and it's sometimes hard to know exactly where the money is going.

0 kommentar(er)

0 kommentar(er)